What Are Office REITs?

In general, large public REITs seek revenue from large real estate portfolios, while 90% net income by law is passed through to passive shareholders. Private REITs may seek income, or a mix of income and capital gains in a multi-year exit strategy.

However, even large public REITs may “cull” their portfolios from time to time, or sell a property if particularly advantageous, resulting in one-time capital income as well as operating revenue.

As might be expected, “office REITs” generally invest in office buildings, and look for high-quality structures to generate rising income, or possibly older towers that can be upgraded or re-positioned for better returns. Some office REITs also hold tech- or life-sciences office campuses in their portfolios.

There are many other types of REITs, such as those that invest primarily in retail, multifamily, industrial or specialty properties, or by region or nation. There are also REITs that primarily invest in property mortgages, as opposed to property directly.How many office REITs are there?

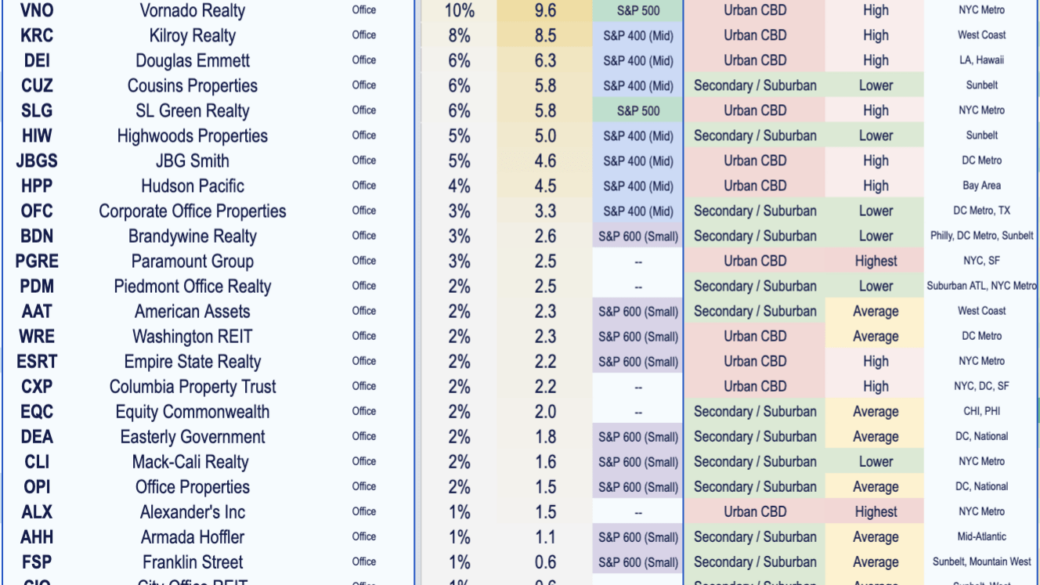

In total, office REITs account for approximately $1.47 trillion of market value (June 2021) and 7% of all REITs. In the US market, there are 26 public REITs that invest primarily in office structures, of which the top 13 account for 80% of the market. See table below.

There are a smattering of indices that broadly represent publicly traded office REITs, including the NASDAQ ETRE Office REIT Index (^NQETO) and the S&P 500 Office REITs (Sub Index), presented by the Financial Times. Though REIT dividends vary with other market returns, such as interest rates, on average office REITs pay dividends in the 3% to 4% range.

Boston Properties (BXP) is a classic office-building REIT, and largest publicly-held owner of class A office properties in the US, with major holdings in Boston, Los Angeles, New York, San Francisco and Washington, DC. The $19.1 billion market-cap company’s portfolio tops 50 million square feet in nearly 200 properties.

Vornado Realty Trust (VNO) primarily owns office and some retail space in New York City, with holdings also in Chicago and San Francisco, and has a $9.6 billion market cap. The REIT owns more than 20.6 million of office space, and another 2.2 million of retail space in Manhattan.

SL Green Realty is a New York City-centric office REIT, billed as Manhattan’s largest landlord. With a market cap of $5.8 billion, the REIT owns 76 buildings totaling 35.3 million square feet.

Office REITs come in several variations, including ones geared to suburban office markets, as opposed to the classic central business district (CBD) or “gateway city” model. Indeed, some office REITs choose to operate in certain constrained suburban submarkets, in which they can gain a substantial market share.

For example, Douglas Emmett (DEI) is a $6.3 billion market cap REIT that operates in select office submarkets in California and Hawaii that are supply constrained with high barriers to entry, offer amenities, and feature proximity to high-end executive housing.

In California, the Douglas Emmett REIT owns eight office properties in upscale West Los Angeles, in such exclusive neighborhoods as Brentwood and Century City. The REIT also owns apartment communities with similar attributes.

Other office REITs choose to operate in secondary, or “non-gateway” markets, such as the $2.6 billion market-cap Brandywine REIT, primarily active in suburban office markets outside Philadelphia, but also recently targeting Texas.

Are Office REITs a Good Investment?

For contrarian investors, bargain-hunters, and dividend-oriented stock buyers willing to take a long view — the answer is probably “yes” (as of December 2021).

The US and the globe has learned about pandemics, and the business and travel restrictions attendant thereto, and the much-discussed “WFH,” or work-from-home movement. The Zoom meeting has gone from Brave New World to tired cliche.

Even before the pandemic, more businesses were attracted to the “shared space” or “co-working space” office models. These models would often do away with the cubicles and walled offices of the past in favor of open-desk plans and even wide planks lining walls. This office arrangement was made possible by the ubiquitous laptop computer and smartphones.

The need for file drawers has been radically reduced, while the employee’s desk is where the laptop and smartphone are. From a landlord’s perspective, the flexible use of space translates into many companies needing fewer employees in the office at any one time, so a reduced need for office space, but an increased need for space per employee, to mitigate social distancing concerns.

All in all, the outlook for US office demand is changing with technology, health concerns and even demographics, as the adult population of the nation grows much more slowly in coming years.

The number of adults in the prime working ages of 25 to 64 in the US was pegged at 173.2 million in 2015 and will rise slowly to 183.2 million in 2035, according to Pew Research Center projections—and much of the growth in workers will happen only if current immigration levels are sustained.

All that said, the Mr. Market inevitably prices in risks and rewards in setting asset prices, and that axiom is no different for office properties. Investors able to selectively and advantageously develop or buy office properties, possibly for upgrading and re-positioning, may find asking prices pencil out.

In addition, there are office markets in regions of the US still in growth mode, either due to immigration from outside the nation, or the internal migrations of Americans to lower-cost, or better tax and regulatory climates. In addition, some coastal gateway markets have such high barriers to entry that office rents may keep rising.

For investors concerned about inflation, real estate and rents have long been the bulwark against the declining dollar, offering better protection than bonds or most stocks. To state the obvious, rents tend to rise along with inflation, and, of course, can top general price hikes if market conditions warrant.

In the five years nearly to the end of 2021, the Financial Times S&P 500 Office REITs (Sub Index) has held its value, recovering from a slump associated with the pandemic.

Certain bellwether office REIT stocks, such as Boston Properties, can be purchased for the same share price as nearly 15 years ago. Today’s office REIT investors certainly have the comfort of not buying at the top, with dividends recovering, and can anticipate rising yields in coming years for better-positioned REITs.

Thanks to online stock brokerages and the internet, investing in office REITs can be accomplished with a few clicks of the mouse.

There is abundant analyst coverage of office REITs, either through brokerages, or for free on such websites as Motley Fool or Seeking Alpha. Services such as Yahoo Finance provide handy scorecards of how the Wall Street analyst community rates any particular stock, including REITs.

For those so inclined, all public REITs make filings with the Securities and Exchange Commission, while transcripts of post-earnings conference calls are easily found online.

In addition to individual REIT stocks, there are REIT exchange-traded funds (ETFs) listed on the exchanges just like stocks, and which offer the great boon of diversity. Basically, an ETF is like a mutual fund, but in general is easily traded and liquid. By far the largest of this class is the Vanguard Real Estate ETF (VNQ), with nearly $50 billion in assets.

The public REITs have many advantages for investors who want liquid exposure to high-quality and managed commercial property, but in recent years more investors are migrating to real estate syndication, especially private equity real estate crowdfunding.

There are pros and cons to both the REITs and real estate crowdfunding into private equity investment opportunities, but perhaps the largest advantage that a well-designed, well-managed crowdfunded syndication has is the close alignment of interests of investors and management.

While Wall Street proper and Corporate America have come a long way towards incentivizing management in recent decades—in particular, the now-common stock options—in real estate syndications the sponsors, also called the general partners or management, are generally co-invested alongside the limited partners, also known as the ordinary, or “passive” investors.

Indeed, in some syndications, certain payout and returns to the general partners can be junior to the limited partner payouts and returns, depending on the syndication structure.

In blunt terms, in better syndications, sponsors and investors hit pay dirt together.

In addition, executive pay at large public REITs is handsome, meaning upper management is financially comfortable even if stock values wane. Another concern is that public companies of all stripes are under increasing political pressure to meet social and environmental goals, which are worthy but more rapidly being adopted by private equity companies, such as here at Rising Realty Partners.

Investors can buy small quantities of REITs or ETFs, but most real estate syndications have minimums, often above $10,000.

For investors who need liquidity, crowdfunded syndications may not be the best fit; in general, syndication investors agree to “lock in” and participate in a three-to-five year plan for a particular property or limited portfolio of assets.

However, while that lack of liquidity is something of a barrier to entry to the real estate syndication business compared to the ability to buy individual share on the public markets, in general the reward to investors is measure by the ‘illiquidity premium’ they receive in terms of higher yields and equity growth in return for being locked up for the duration.

The market charges higher interest rates for long-term bonds than short-term notes, and that instructive example holds for private equity real estate investors also.

In terms of risks, the REITs with their huge portfolios of property are probably less risky than a syndication developing or improving a lone property—but again, risk and reward are paired in the investment world. The riskier the investment, the higher the yields.

However, REITs are also subject to the whims of the stock market and the news cycle, creating considerable volatility relative to private equity investments. Being completely liquid i.e., tradable at a moment’s notice, publicly traded REITs tend to behave more like stocks than they do real estate and can be especially badly hit when there is a recession, such as during the 2008-2010 global financial crisis.

This volatility combined with a ‘liquidity’ premium increases the costs of running an office REIT substantially. Converting an inherently illiquid asset such as commercial real estate into a purely liquid one requires considerable financial engineering and with that comes additional costs which are passed on to investors. These additional costs do not occur in private equity real estate investment opportunities where investors accept longer term holds on their investments in return for lower volatility, higher returns, and market value pricing for their investments.

That said, another side of the risk picture is the enormous amount of analyst coverage attending to nearly all public REITs, vs. a near-complete absence of analysis coverage for any particular real estate syndication, crowdfunded or otherwise.

In a syndication, the investor is advised to conduct due diligence, with careful scrutiny of offering documents and sponsors, whereas for REITs prudent investors will incur the same amount of work examining analyst and other third-party reports. Indeed, investors may wish to invest the minimum amount required when participating in a crowdfunded syndicate for the first time and increase their investments after a sponsor has delivered as promised.

The outlook for US office markets remains challenging, although certain Sunbelt cities with growing tech sectors have plenty of demand.

Enabled by evolving technologies, employers are developing “hybrid” office models, with more management receptivity to employees working from home, even while the demographics point to a slowing in the growth of the national workforce in the decades ahead.

Moreover, office-tower investors and others now know they face a world that may endure a pandemic in any season.

But as every veteran of financial markets knows, the time to buy is when challenges are presented that push the risk-averse aside, translating into higher returns for those willing to take chances.

Our Company

Our Company Our Team

Our Team Portfolio

Portfolio Services

Services News

News Insights

Insights Videos

Videos Podcast

Podcast