ESG in Commercial Real Estate

Institutional and commercial property owners globally are increasingly tasked with challenges that extend beyond old-school spreadsheet costs, rents, and profits, and to such issues as power and water use, waste recycling, the welfare of building tenants and even building connections to area streets and communities.

The COVID-19 pandemic has placed additional challenges before building owners regarding sanitation, air quality and public safety.

Many commercial property owners find that they are increasingly expected to accommodate multiple stakeholders, including investors, customers, tenants, local residents and officials, and national or regional government officials issuing edicts.

Successful commercial property owners have survived through past adversities by engaging economic and political environments, not retreating. Today’s elite property owners excel at adaptation and, when necessary, turning financial lemons into lemonade. Commercial property owners and investors have joined tenants and governments in developing “green” or sustainable assets that also have better foundations for future prosperity.

Rising Realty Partners recently became a signatory of the United Nations-supported Principles for Responsible Investment (PRI), the leading international network of institutional investors committed to including environmental, social and governance factors in their investment decision making. Such ideals will carry over into the operation of the Rising portfolio.

With global warming and the health issues raised by the pandemic, the prospects are that ESG ideals will become ever larger and more embedded into institutional property acquisition, development and operations, but will also be managed to protect and even enhance profits.

Our team has proven that ESG is an “Impact Strategy” that creates alpha for investors — something we like to call “impact as alpha” — meaning that carbon reduction, health and wellness and social impact strategies create additional value in our projects. Cumulatively, these strategies create an Impact Strategy that allows our investors to make more money.

What Does ESG Mean in Commercial Property

As a practical matter, for commercial property owners and managers the “E” in ESG, or environmental, generally boils down to using less energy and water, and recycling office waste.

While the essence of ESG is simple, the execution takes skill and commitment, and the latest technologies. The stakes are large; by industry estimates, existing buildings directly and indirectly account for 28% of carbon emissions globally. Another 12% of global CO2 emissions each year are attributable to building construction.

In a nutshell, for building owners the acronym ESG means installing more-efficient heating, ventilation and air-conditioning (HVAC) systems, plumbing fixtures that reduce water-flow, and programs to recycle office paper, and tenant-generated plastics and glass, usually bottles.

Replacing older lighting systems with new efficient light-emitting diode (LED) bulbs is another step to a greener building, as are sophisticated sensors that shut down or temper lights and HVAC systems when not needed. The important task of daily monitoring of new procedures and systems falls upon assiduous building management.

In some climates, the installation of water retention systems that collect run-off from air-conditioners for channeling into onsite gardens has been successful.

For more-serious building retrofits there are additional techniques, such as the addition of structural shading or screens to building exteriors to reduce solar exposure, rooftop plantings or shadings, and the installation of new-generation windows, known as “low-e glass,” that let in light but not heat.

Some innovative building owners even add natural illumination to interior areas though “light tunnels” that gather and reflect into dark interior spaces naturally.

In drier regions of the world fresh water has long been a scarce resource, and becoming ever more so as urban populations expand, often away from water supplies—the American Southwest is a prime example of these trends. The recapture of “grey water” from large commercial structures in such regions is often advisable, as well as the use of drought-tolerant plants in garden areas.

Tower owners have made waste-recycling in central business districts the norm in recent years, with office denizens encouraged to put paper, glass or plastic into discreet and marked containers, to ease recycling at time of pick-up. BTW, that once-iconic office product—paper, as in paperwork—has been something of a success story in recycling circles, with about two-thirds of paper products recycled every year, according to the American Forest & Paper Association.

The rising tide of ESG-consciousness has been accompanied by a similar increase in industry organizations devoted to promoting and measuring ESG-ness in the commercial property sector.

One of the largest global organizations is the Netherlands-based Global Real Estate Sustainability Benchmark, or GRESB, which provides industry benchmarks and analytical tools to assess the performance of buildings and portfolios, and to help in meeting ESG reporting standards.

In the U.S., the Leadership in Energy and Environmental Design designation, or LEED, is a widely used green-building rating system, overseen by the U.S. Green Building Council.

The Business Case of ESG in Commercial Property

Obviously, the commercial building that consumes less electricity and water has payoffs to the bottom line, while upgraded and smarter HVAC and lighting systems present to potential buyers a tight, well-run structure that is less likely to require expensive maintenance or retrofitting in the foreseeable outlook.

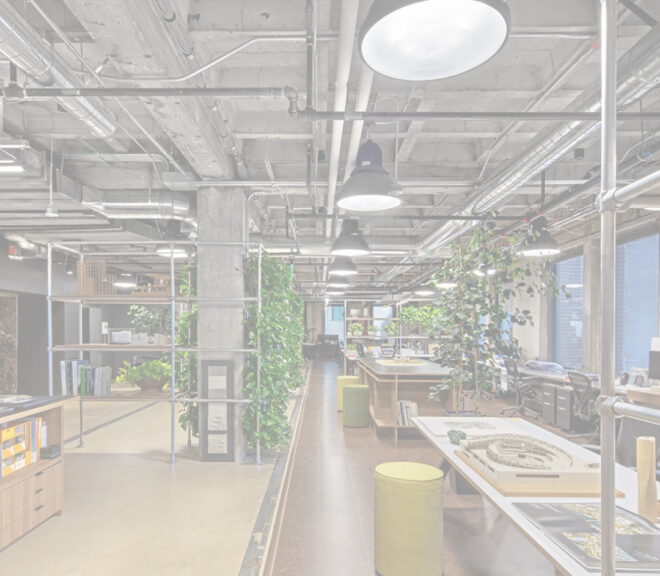

In obtaining quality tenants, the perceived environmental qualities of a building can also be of benefit. Tenants are increasingly seeking efficient, healthy and green-certified working warrens, both for perceived safety benefits but as an expression of their green concerns and affiliation with like-minded business partners.

Thus, incorporating ESG into property operations can lead to increased profitability through improved tenant attraction and retention, improved returns on investment and ultimately higher property values.

In addition, lenders and insurers are taking a more-rigorous examination of the “risk management” profiles presented by owners of large commercial structures.

Buildings that have undergone an ESG audit have more often identified potential risks to tenants and owners, as well as possible hazards presented by evolving energy and water markets, or weather conditions, and thus qualify for for better terms on financing or insurance.

Buildings on the cutting edge of ESG are also less likely to suffer serious setbacks when regional or national governments impose tougher standards on carbon emissions, energy use or waste generation.

One may question government overreach, but as a practical matter authorities worldwide are stepping up rules against carbon emissions.

For example, California required all new residential construction be “net zero” after 2020, which means a structure must produce as much energy as it consumes over the course of a year. Moreover, all new commercial construction in California must be net zero after 2030.

In general, whether in commercial real estate or other enterprises, to be prepared for increasing regulations or costs regarding carbon emissions and energy use is good planning.

With the advent of the COVID-19 pandemic, the need for building owners to upgrade interior air quality moved to the forefront. Some office tower owners have installed “Merv 13” or better filters on building HVAC systems, which reduce particles in the air, and even reduce viral loads. Of course, the installation of antiseptic liquid dispensers and body-temperature measuring devices has become commonplace.

Most commercial property owners have improved janitorial-staff supplies to not only be green, but help disinfect public areas. As new products and technologies merge to limit respiratory ailments, the commercial property sector will likely lead in adoption—office towers are eager for tenants to resume normal operations, as opposed to, say, online enterprises.

The “S” in ESG stands for social, and while much less measurable or quantifiable than the environmental side of the acronym, the social front has also been of increasing interest to institutional property owners.

The social issues the large commercial property owners may face include creating vending or business opportunities for local enterprises, striving for a diverse and inclusive building workforce, and a knowledge of labor standards and working conditions within a building.

Some commercial property owners have developed a code of conduct for vendors who employ unskilled employees.

Certain tenant amenities, such as showers and changing rooms to facilitate bicycling to work, or a building day-care center, can also add to building’s social standing.

Community holiday charity drives, and onsite group exercise facilities and programs are also increasingly components of ESG plans are larger office buildings. Some property owners are offering employees opportunities to engage in charity work on company time, especially if related to immediate community.

Though controversial, the social vetting of tenants may be a necessary aspect of modern-day property ESG. Some organizations are seen as polarizing, and housing such tenants may be seen as a political endorsement by building owners.

In a lighter vein, some commercial property owners are encouraging beekeeping or even the nesting of peregrine falcons on tower properties, as a way to improve connections with urban residents and wildlife enthusiasts.

Another interesting recent trend is for commercial property owners to “offset” carbon emissions by financing the planting of trees on large acreages outside urban areas, which then absorb CO2 from the air. The effective purchase of electricity from renewable sources is another option to effectively get to net zero for large commercial projects.

Most large office buildings cannot get to net zero even after extensive retrofits and design measures, but can participate in programs to mitigate net energy consumption and related emissions.

The set-aside of building parking spaces for electric vehicles, complete with charging stations, is another option available to ESG-oriented managements.

“You can’t manage what you don’t measure,” is one of the cliches of the ESG-crowd in commercial real estate—and even measuring the quantifiable comes loaded with qualifications.

For example, what could be a heroically low energy consumption on per square foot basis for an older structure in a harsh climate might be considered somewhat lax for a new building in a forgiving climate. Some smaller, intensively designed commercial structures in temperate zones have been able to get to true net zero, but that is an impossibility for larger towers in other climates, where the purchase of electricity from renewable sources might be necessary to get to “net zero.”

Nevertheless, in the US many commercial property denizens have turned to the Energy Star rating system, provided by the U.S. Environmental Protection Agency, to benchmark their buildings against industry targets and norms in terms of electrical use.

For indoor air quality, the RESET Standard, which available through a free app offered by the Canadian organization GIGA, has been gaining acceptance. The sensor-based and performance-driven data standard RESET includes a certification program for interior environments.

For a broader measurement of a building’s sustainability profile, there is also the aforementioned LEED rating system, in which buildings can receive “silver,” “gold,” and other ratings based on a wide variety of measures, including such items as parking racks for bicycles, and connections to mass transit.

Measuring the “social” in ESG is obviously even more subjective than the metrics for the environmental aspects of a building or portfolio, but gifts to community and charities can be tallied up, as well as hours of employee participation in community, charitable or wellness programs.

Something of a caboose on the ESG acronym is the “G” for governance, but integrity, oversight and transparency of the E and S in ESG is essential, say proponents. Some property managers are applying for “B corporation” certification, which is a “social and environmental performance” accreditation for-profit companies, conferred by B Lab, a global nonprofit organization.

Many commercial property owners are embracing ESG standards, given the rising prominence the climate-change issue, and probable future government edicts regarding energy and water consumption. We believe that the best way to create alpha, the additional value to our investors, is to work hard on Impact Strategies so that our properties measurably reduce carbon, promote the health and wellness of our tenants and employees and provide a meariable, positive social impact in the communities our projects reside.

The possibility of global pandemics—no longer speculative—means building owners everywhere want to assure tenants and customers their structures are as safe as reasonably possible, and that indoor air quality is acceptable.

The tide of political and popular demands for social contributions from private-sector enterprises is also rising, perhaps more illuminated than earlier eras due to the prevalence of social media and even ubiquitous cameras. Again, many property owners are choosing to accommodate the times through the establishment of social programs.

However, skillful property managers are deploying ESG programs to reduce costs, and to ensure safe, well-run and audited structures, and to develop positive relations with neighborhood communities. The path forward in property ownership and management is perhaps more complicated than ever, but surmounting challenges also present opportunities for managements that can get ahead of the curve.

Podcast

Podcast